I will advise this company to everyone who will need the services that these people provide.

I will advise this company to everyone who will need the services that these people provide.

I will advise this company to everyone who will need the services that these people provide.

I will advise this company to everyone who will need the services that these people provide.

I will advise this company to everyone who will need the services that these people provide.

I will advise this company to everyone who will need the services that these people provide.

I will advise this company to everyone who will need the services that these people provide.

I will advise this company to everyone who will need the services that these people provide.

I will advise this company to everyone who will need the services that these people provide.

I will advise this company to everyone who will need the services that these people provide.

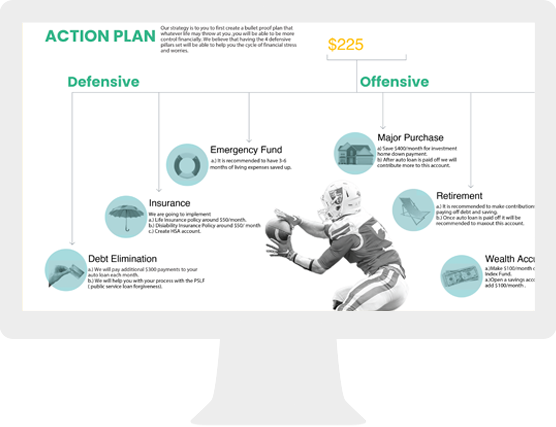

Have you ever wondered if you should pay for your next car in cash, or if you should get a car loan? What about if you have the right amount of Life Insurance? Perhaps you're wondering if your on track for your retirement? Or if you’ll have enough saved to put your child through college? Searching for these answers on the internet won’t give you the custom advise you need. That is where Foursteps comes in.

Working with a Foursteps Financial Advisor mean you’ll have access to personalized advice whenever and wherever you need it, at a fraction of the cost others pay for the same level of service.

At Foursteps we believe that financial planning isn’t an event, it’s a process. A financial plan is a living, breathing, document and should be updated frequently. While most firms will charge you to meet more than once a year, at Foursteps we include four meetings each year in the price of the subscription. Oh yeah, and there isn’t a limit to the number of emails or phone calls you get as a valued client.

As you become a paid member, an advisor will be in contact with you. You can email, text, or schedule a video conference or call whenever you're in need. Feel Free to contact your advisor anytime!

At Foursteps we do much more than budgeting. We help you save time, effort and money. We assist with budgeting, financial advising, work benefits, insurance, debt elimination and much more.

The Foursteps state-of-the-art budgeting app uses the latest in Fin-Tech to provide customized budgeting tools and analysis, as well as up-to-the-minute Financial Planning reports. What does this mean for you? Information is power, and the budgeting app coupled with the knowledge and experience of a Financial Advisor means you’ll be locked and loaded with information that will make your financial dreams come true.

Security is of the utmost importance at Foursteps. Foursteps is a fiduciary, which means we will always place our clients interest ahead of our own. This isn’t only true about the advice we give, but also in the way we protect and defend client information and privacy rights. Our state-of-the-art technology uses various methods to keep your information safe.

Let us worry about your investments so you don’t have too. One of the services we offer at Foursteps is investment management. This type of service often costs around 1.25% of the account values being managed each year. At Foursteps it only costs 0.9% each year. That’s a 28% lower fee for the same level of service you could find elsewhere.

Foursteps won’t actually have possession of your money. Your money will be held safe and sound at a custodian called E-Trade, and the investment allocations will be directed by you, your Foursteps Financial Advisor, and a Symmetry Partners Advisor (a third party money manager). Foursteps will provide you with quarterly reports via email on the progress of your investments, and E-Trade will provide you with monthly statements. You can be as involved as much or as little as you’d like.